Co-Founder Agreement, why it is important for small business.

You and your best friends have just come up with a crazy idea one night and as you talk, the energy and excitement grows as the vision of a startup forms. You have the next Uber or Airtasker on your hands, right here.

In addition, you immediately fast forward 5 years into your future (in your head) and you see yourself living on easy street. Your startup is riding high, it’s based out of co-working hub with foosball tables, couches, sleeping pods, a chef, coffee on demand, it’s got it all.

You’re all pumped and ready to dive in. One for all, and all for one!

Wait a second, let’s stop and look at how this could go. This scenario could go 1 of 3 ways:

- Your startup fails. It was a hard pill to swallow but the stacks were against you from the beginning so you all go your separate ways, perhaps slightly worse off financially

- Your startup is a huge success but there are cracks that are only getting bigger. Communication issues between the founders are leading to internal clashes and disputes, and a co-founder now wants to exit due to the dissolution of the friendships formed over many years but there are no agreements in place to manage this

- Your startup is a success. As founders, you could see the potential and rapid growth of the company, so the required work was put in to protect and secure yourselves and your friendships, and plan for your startup’s future.

Scenario 3 is the startup dream. No bumps along the way and all relevant agreements are put in place from the outset. The founders have been smart by forward thinking, covering all the angles, and putting in the effort to protect themselves and their asset. The focus remains on the startup’s future and there are no distractions.

Now, let’s come back to reality. A lot of startups are boot strapping in the early stages. Why spend money on lawyers and drafting agreements when there’s no money coming in and you haven’t built anything yet?

With all the possible disputes that can occur in a startup, at any phase, it’s important to have certain agreements in place. You are already beating the odds if you add this extra, crucial step. For co-founders, it’s a co-founder agreement.

Just as a climber needs the correct equipment to climb Mount Everest, co-founders need a co-founder agreement to set solid foundations and improve the chances of success.

A co-founder agreement will set the scene from the outset and will keep the company on track should any disputes arise, such as differences of opinion, a founder wanting to exit the startup, or dealing with underperformance.

In other words, a co-founder agreement will lay out the foundations, intention and business structure of the startup, and set the scene for the rights, responsibilities, and liabilities of each party. By creating the agreement in the harmonious stage, at the early stages of the startup, before any conflict has arisen, or even been contemplated, there is clarity around how disputes can be managed. These agreements manage awkward topics like money and selling shares if a co-founder decides to leave.

What goes into a co-founder agreement?

There are essentials that should be included in any co-founder agreement:

- Operations of the business, such as the commitment of each co-founder and how much time they will spend on the startup per day.

- Be clear and distinct about the responsibilities and obligations of each co-founder.

- Interest in ownership. Not all founders are created equal. Identify and define the allocation of interest of each co-founder. It might sound logical to have a 50% split, however this may not always be the case. Perhaps there is a main founder who has sourced a secondary founder to manage a specific part of the business, for example a web developer.

- Vested shares are a common arrangement. They are accrued over time rather than given out in one lump sum, and are used as an incentive for the founders to remain and continue to help grow the startup. The longer the founders stay in the company and achieve specified targets, the more shares they accrue.

- A section in the agreement should set out the likely scenarios of when a co-founder wants to exit and sell, or transfer their shares.

Founders may not see what will happen down the track as their startup grows, but a co-founders agreement will. The co-founders agreement prepares the startup for stronger growth down the track and aims to settle, organise and manage issues up the road when the stakes are high. Having a solid structure from the outset will lead to higher chances of success.

If you have questions about your co-founder agreement, or you need to draft a co-founder agreement, please contact our friendly team.

Important disclaimer: The material contained in this publication is of a general nature only and it is not, nor is intended to be, legal advice. This publication is based on the law as it was prior to the date of your reading of it. If you wish to take any action based on the content of this publication, we recommend that you seek professional legal advice.

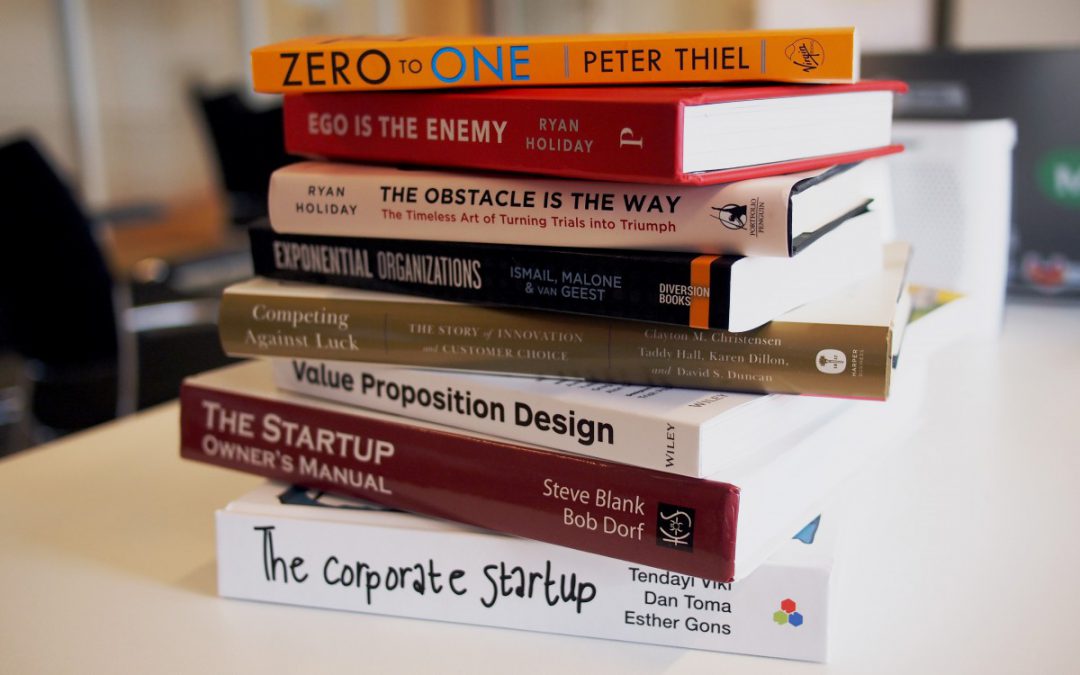

Photo by Daria Nepriakhina on Unsplash